Did you know that the average American spends over 20 years in retirement? That’s a significant portion of your life, and it’s crucial to ensure you have the financial resources to maintain your desired lifestyle during this time. An age calculator for retirement can be a powerful tool in helping you determine the best time to retire based on your unique financial situation.

Determining your ideal retirement age is a crucial step in planning for your financial future. An age calculator for retirement can help you understand when you can realistically retire based on factors such as your current savings, investment portfolio, desired retirement income, and expected longevity. By using a retirement age calculator, you can make informed decisions about your retirement timeline and ensure you have the resources to maintain your desired lifestyle in your golden years.

Key Takeaways

- An age calculator for retirement can help you determine your ideal retirement age based on your financial situation and lifestyle goals.

- Factors such as your current savings, investment portfolio, desired retirement income, and expected longevity can all influence your optimal retirement age.

- Using a retirement age calculator can help you make informed decisions about your retirement timeline and ensure financial security in your golden years.

- Retirement planning is crucial for maintaining your desired lifestyle and ensuring a comfortable, financially secure retirement.

- Evaluating your retirement income sources, including Social Security and pension plans, is an important step in determining your ideal retirement age.

Understanding the Importance of Retirement Planning

Retirement planning is a crucial aspect of ensuring a comfortable and financially secure future. The age at which you retire can have a significant impact on your long-term well-being. Whether you’re just starting to save for retirement or are nearing the end of your career, understanding the factors that influence your retirement age is essential for making informed decisions.

Why Retirement Age Matters

Your retirement age is a crucial factor in determining the financial resources you’ll have available during your golden years. The earlier you retire, the longer your retirement savings need to last, which can put a strain on your financial security. Conversely, delaying retirement can allow you to accumulate more savings and potentially take advantage of employer-sponsored retirement benefits, such as pension plans and 401(k) contributions. By carefully considering your retirement age, you can ensure that your financial planning for retirement aligns with your desired lifestyle and income needs.

Factors Influencing Retirement Age

Several factors can influence your ideal retirement age, including your retirement planning, current savings, investment portfolio, desired retirement lifestyle, and anticipated longevity. Additionally, your health and any potential changes in government policies or regulations around retirement readiness can also play a role in determining the best time for you to retire. By understanding these factors, you can develop comprehensive financial planning for a retirement strategy that addresses your unique needs and helps you achieve your long-term goals.

Age Calculator for Retirement

Retirement age calculators are powerful tools that can help you determine the best time to retire based on your unique financial situation. These calculators typically take into account factors such as your current age, retirement savings, expected retirement income, and desired retirement lifestyle to provide a personalized estimate of your ideal retirement age. By using an age calculator for retirement, you can better understand your financial readiness, identify any gaps in your savings, and make informed decisions about your retirement timeline.

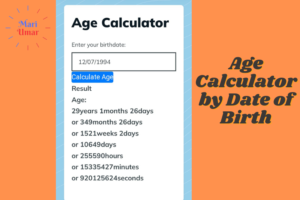

How Age Calculators Work

Retirement age calculators use a variety of inputs to assess your financial readiness and project your ideal retirement age. These retirement planning tools often consider factors like your current age, existing retirement savings, expected Social Security benefits, and desired monthly income in retirement. Based on this information, the calculator will provide an estimate of the best age to retire based on your specific circumstances.

Benefits of Using an Age Calculator

Using a retirement age calculator can offer several benefits in your retirement planning process. By understanding your retirement readiness assessment, you can identify areas where you may need to increase your savings or adjust your retirement timeline. Additionally, these calculators can help you explore different scenarios, such as the impact of retiring early or delaying retirement, to make the most informed decision about your ideal retirement age.

| Benefit | Description |

|---|---|

| Personalized Projections | Retirement age calculators provide a customized estimate of your ideal retirement age based on your unique financial situation and goals. |

| Retirement Readiness Assessment | These tools can help you evaluate your current financial preparedness for retirement, identifying any gaps or areas that need improvement. |

| Scenario Planning | Age calculators allow you to explore different retirement scenarios, such as the impact of retiring early or delaying retirement, to make the best decision for your long-term financial well-being. |

| Informed Decision-Making | By using a retirement age calculator, you can make more informed decisions about your retirement timeline and ensure you have the resources to maintain your desired lifestyle in your golden years. |

Determining Your Ideal Retirement Age

Determining your ideal retirement age requires a comprehensive assessment of your financial readiness, lifestyle goals, and health considerations. When evaluating your financial readiness, you’ll need to review your current savings, investments, and projected retirement income sources, such as Social Security and pension plans. This process will help you assess your retirement readiness and identify any gaps that need to be addressed.

In addition to your financial situation, it’s important to consider your desired retirement lifestyle, including travel plans, hobbies, and other expenses. Understanding your lifestyle goals will enable you to plan for a retirement that aligns with your priorities and ensures a fulfilling, comfortable life in your golden years.

Finally, your health and expected longevity can also play a significant role in deciding the best time to retire. Factors such as your current health condition, family history, and access to quality healthcare can all influence your ideal retirement age. By carefully considering these factors, you can make an informed decision about when to step away from the workforce and embark on the next chapter of your life.

Retirement Income Sources

As I plan for my retirement, it’s crucial to understand the various income sources that can provide financial support during my golden years. Social Security benefits are a key component of many retirees’ income, and it’s important to understand how to maximize these benefits based on my specific situation.

Social Security Benefits

Social Security is a government-sponsored retirement program that provides a steady stream of income to eligible individuals upon retirement. The amount of Social Security benefits I can expect to receive depends on factors such as my earnings history, the age at which I choose to start collecting benefits, and any adjustments made to the program over time. By carefully navigating the complexities of the Social Security system, I can ensure I’m receiving the maximum benefits I’m entitled to.

Pension Plans and Employer-Sponsored Retirement Accounts

In addition to Social Security, pension plans and employer-sponsored retirement accounts like 401(k)s and IRAs can be valuable sources of retirement income. If I’ve had the opportunity to participate in such plans throughout my career, these accounts can provide a supplementary income stream to complement my Social Security benefits. By understanding the nuances of these retirement savings vehicles, I can develop a comprehensive strategy to ensure a comfortable and financially secure retirement.

FAQ

What is an age calculator for retirement?

An age calculator for retirement is a tool that helps you determine the best time to retire based on factors such as your current savings, investment portfolio, desired retirement income, and expected longevity. By using a retirement age calculator, you can make informed decisions about your retirement timeline and ensure you have the resources to maintain your desired lifestyle in your golden years.

Why is retirement planning important?

Retirement planning is essential for ensuring a comfortable and financially secure retirement. The age at which you retire can have a significant impact on your long-term financial well-being. Factors such as your savings, investments, health, and desired lifestyle all play a role in determining your ideal retirement age. By understanding the importance of retirement planning and the various factors that influence your retirement age, you can make more informed decisions about when to retire and how to best prepare for this important life transition.

How do retirement age calculators work?

Retirement age calculators are powerful tools that take into account factors such as your current age, retirement savings, expected retirement income, and desired retirement lifestyle to provide a personalized estimate of your ideal retirement age. By using an age calculator for retirement, you can better understand your financial readiness, identify any gaps in your savings, and make informed decisions about your retirement timeline.

What factors should I consider when determining my ideal retirement age?

Determining your ideal retirement age requires a comprehensive assessment of your financial readiness, lifestyle goals, and health considerations. When evaluating your financial readiness, you’ll need to review your current savings, investments, and projected retirement income sources, such as Social Security and pension plans. Additionally, it’s important to consider your desired lifestyle in retirement, including travel plans, hobbies, and other expenses. Finally, your health and expected longevity can also play a significant role in deciding the best time to retire. By carefully considering these factors, you can make an informed decision about your ideal retirement age.

What are the main sources of retirement income?

When planning for retirement, it’s crucial to understand the various income sources that can provide financial support during your golden years. Social Security benefits are a key component of many retirees’ income, and it’s important to understand how to maximize these benefits based on your specific situation. Additionally, pension plans and employer-sponsored retirement accounts, such as 401(k)s and IRAs, can be valuable sources of retirement income. By carefully evaluating your retirement income sources, you can develop a comprehensive strategy to ensure a comfortable and financially secure retirement.